Investing in a high-yield savings account (HYSA) can be a powerful way to grow your savings over time. With an annual percentage yield (APY) that significantly outpaces that of a traditional savings account, HYSAs offer an attractive combination of security, accessibility, and compounding interest. But just how much can you earn if you deposit $10,000 into a high-yield savings account? In this article, we’ll explore the potential earnings, the impact of compounding interest, and why starting early is crucial for maximizing your returns.

What is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that offers a much higher interest rate compared to a regular savings account. Typically, the interest rate on HYSAs ranges between 2.00% to over 5.00% APY, depending on the financial institution and prevailing market conditions. This contrasts sharply with the average traditional savings account, which often offers rates below 0.50% APY.

The key benefits of high-yield savings accounts include,

Higher Interest Rates: These accounts provide a significantly better return on your deposits compared to standard savings accounts.

Safety: Most HYSAs are insured by the FDIC (Federal Deposit Insurance Corporation) or NCUA (National Credit Union Administration) up to $250,000, making them a low-risk investment.

Liquidity: Unlike certificates of deposit (CDs) or other investment vehicles, your money remains accessible, usually with no penalties for withdrawal.

No Risk of Loss: Unlike stock market investments, the principal amount in your savings is not subject to market volatility.

Calculating Earnings with a High-Yield Savings Account

To illustrate the earning potential of a high-yield savings account, let’s use an example: a $10,000 initial deposit with a 5.00% APY.

Yearly Earnings on a $10,000 Deposit at 5.00% APY

The formula to calculate simple interest over one year is,

Interest = Principal X Rate

For a $10,000 deposit at 5.00% APY, the interest earned in one year would be:

Interest = 10,000 X 0.05 = 500

So, you would earn $500 in interest after one year. However, the true power of a high-yield savings account lies in the concept of compound interest.

The Power of Compound Interest

Compound interest is the process of earning interest on both the initial principal and the accumulated interest from previous periods. In a high-yield savings account, interest is typically compounded monthly, meaning the interest earned each month is added to the principal, and the next month’s interest calculation is based on this new balance.

Compounding Monthly: How It Works

Let’s break down how compound interest works with a $10,000 deposit in a high-yield savings account with a 5.00% APY, compounded monthly.

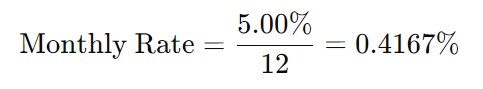

Monthly Rate Calculation: The annual rate of 5.00% is divided by 12 to get the monthly interest rate.

First Month’s Interest: For the first month, the interest earned would be:

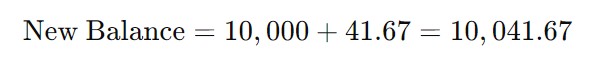

Adding Interest to Principal: The new balance after the first month would be:

Subsequent Months: The second month’s interest is then calculated based on the new balance, continuing each month in a similar manner.

Total Interest Over One Year

At the end of one year, the total amount in the account would be approximately $10,511.62, showing that compounding interest yields slightly more than simple interest. This extra $11.62 might seem small, but over time, the effects of compounding become much more pronounced.

Long-Term Growth: Compounding Over Decades

To truly understand the potential of a high-yield savings account, let’s look at a longer time frame. Suppose you deposit $10,000 into a high-yield savings account with a 5.00% APY at age 20 and leave it untouched until you turn 65.

Time Period: 45 years

Initial Deposit: $10,000

APY: 5.00%, compounded monthly

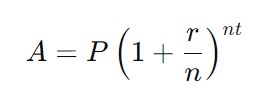

Using the compound interest formula,

where:

A = the amount of money accumulated after n years, including interest.

P = the principal amount ($10,000).

r = annual interest rate (0.05).

n = number of times interest is compounded per year (12).

t = time the money is invested for in years (45).

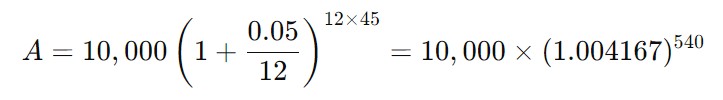

Substituting the values:

Calculating this:

By the time you turn 65, your $10,000 will have grown to approximately $129,800, earning you nearly $119,800 in interest alone. This demonstrates the exponential power of compounding interest over long periods.

Comparing High-Yield Savings Accounts to Traditional Savings Accounts

While HYSAs are attractive due to their higher returns, it’s helpful to compare them to traditional savings accounts to understand the value they bring.

Traditional Savings Accounts

Average APY: Traditional savings accounts typically offer around 0.01% to 0.50% APY.

Earnings on $10,000: With a 0.05% APY, you would earn just $5 per year on a $10,000 deposit.

Compounded Growth: Over the same 45-year period, a traditional savings account would yield approximately $12,500, earning just $2,500 in interest.

High-Yield Savings Accounts

Average APY: Many HYSAs currently offer between 4.00% to 5.00% APY, with some even exceeding 5.00%.

Earnings on $10,000: With a 5.00% APY, you would earn $500 in the first year alone.

Compounded Growth: Over 45 years, the difference in total accumulated savings is staggering compared to a traditional account, with nearly $117,300 more in interest.

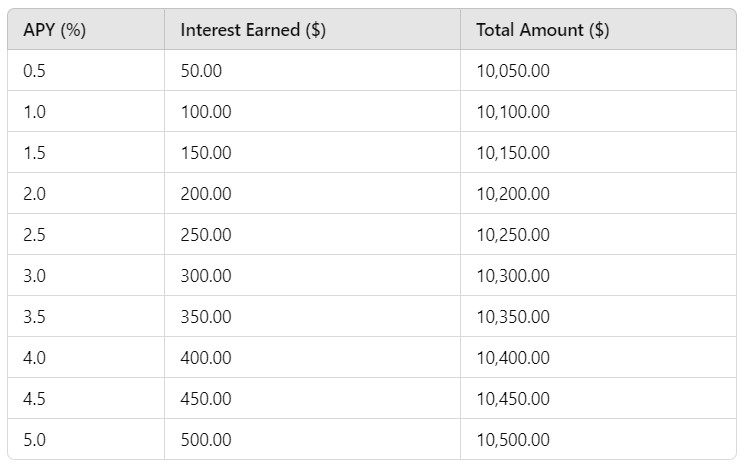

Earnings On $10,000 In A High-Yield Savings Account After One Year

Here's the table showing the earnings on $10,000 in a high-yield savings account after one year,

Factors to Consider When Choosing a High-Yield Savings Account

While high-yield savings accounts offer significant advantages, it’s essential to consider a few factors when choosing the right account.

Interest Rates: Look for the highest APY available, but also ensure that the rate is stable and doesn’t drop significantly after an introductory period.

Fees: Some accounts may have maintenance fees or minimum balance requirements that could offset the interest earned. Look for accounts that are fee-free or have manageable requirements.

Access and Flexibility: Ensure the account offers easy access to your funds, whether through online banking, ATMs, or transfers to other accounts.

FDIC/NCUA Insurance: Verify that the account is insured by the FDIC (for banks) or NCUA (for credit unions) for up to $250,000, ensuring your money is safe.

Compounding Frequency: Monthly compounding is typical for HYSAs and maximizes interest growth. Be cautious of accounts that compound less frequently.

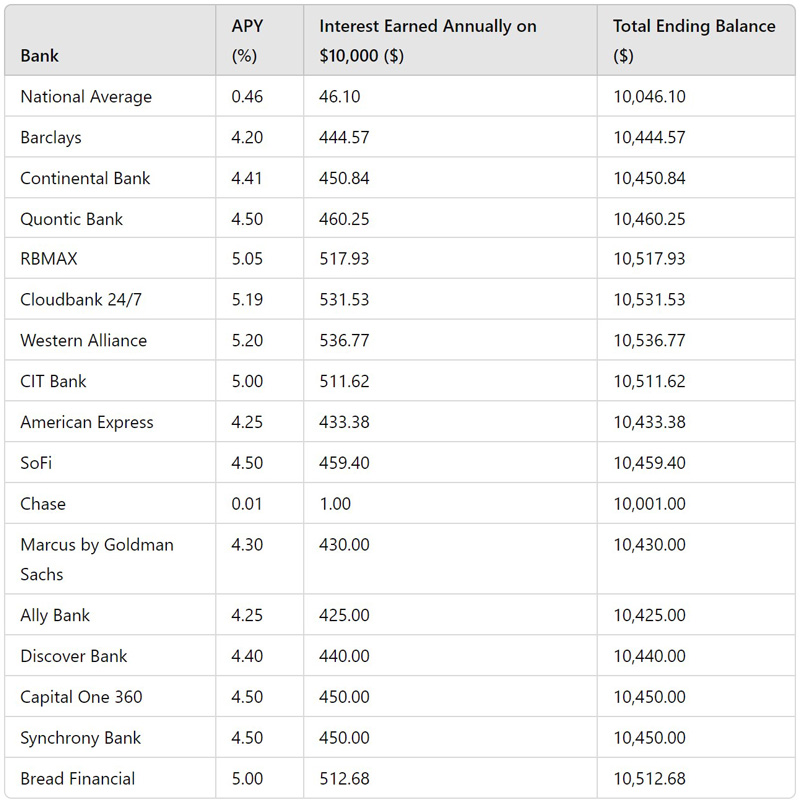

Earnings with Accounts by top banks

Here's a comparison of potential earnings on a $10,000 deposit in high-yield savings accounts offered by top banks. This assumes a 5.00% APY compounded monthly, which is representative of some of the best rates available, though actual rates can vary.

The Importance of Starting Early

One of the key takeaways from the power of compound interest is the significant impact of time. The earlier you start saving, the more you benefit from compounding. Here’s a closer look at why starting early matters.

Exponential Growth: The effect of compounding is exponential, meaning your money grows faster the longer it stays invested. The growth curve steepens over time, making early contributions far more valuable.

Small Differences, Big Impact: Even small differences in APY can lead to vastly different outcomes over decades. For example, earning 4.00% versus 5.00% might not seem dramatic in the short term, but over 45 years, it could mean tens of thousands of dollars in additional interest.

Peace of Mind: Starting early reduces the pressure to save large amounts later in life. By letting your money work for you over time, you can achieve financial goals with less stress and more flexibility.

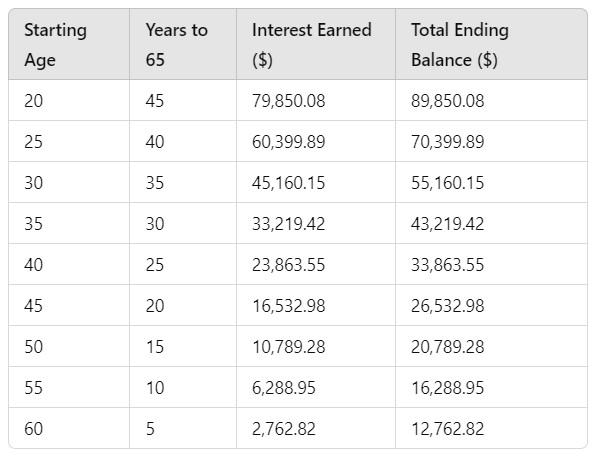

How much could I earn by 65 with $10,000 in a high-yield savings account?

This table shows how a $10,000 deposit with a 5.00% APY grows over time, emphasizing the importance of starting early to maximize interest earnings.

Maximizing Your High-Yield Savings Account

To get the most out of a high-yield savings account, consider the following tips.

Set Up Automatic Transfers: Automating your deposits can help you stay disciplined and consistently grow your savings.

Avoid Withdrawals: Since HYSAs are liquid, the temptation to dip into your savings can be high. Set clear goals and only withdraw if absolutely necessary to preserve the benefits of compounding.

Shop Around Regularly: Interest rates on HYSAs can fluctuate. Periodically review your account’s rate and compare it with other options to ensure you’re still getting the best deal.

Use for Short-to-Medium-Term Goals: High-yield savings accounts are excellent for emergency funds, saving for a down payment, or other short-to-medium-term financial goals where accessibility and security are priorities.

Reinvest Earnings: Instead of spending the interest earned, keep it in the account to continue benefiting from compound growth.

A high-yield savings account is a powerful financial tool that offers a safe and effective way to grow your money over time. By taking advantage of higher interest rates and the power of compound interest, even a modest initial deposit of $10,000 can accumulate substantial wealth over the years. The earlier you start, the more you can maximize your returns, making high-yield savings accounts an essential component of any long-term financial strategy. So, whether you’re saving for retirement, an emergency fund, or other financial goals, consider the value of a high-yield savings account to make your money work harder for you.

Fees in High-Yield Savings Accounts

Fees can significantly impact the earnings in a high-yield savings account, often diminishing the benefits of higher interest rates. Understanding the types of fees associated with savings accounts and how they can affect your overall earnings is crucial when choosing an account. Here's a detailed look at how fees can erode your savings.

Types of Fees in High-Yield Savings Accounts

Monthly Maintenance Fees

Some banks charge a monthly maintenance fee just for keeping your account open. These fees can range from a few dollars to as much as $15 per month.

Impact: A $10 monthly fee would cost you $120 annually, which would directly reduce your earned interest. For instance, if you earned $500 in interest but paid $120 in fees, your net gain would only be $380.

Excessive Withdrawal Fees

Federal regulations typically limit savings accounts to six withdrawals or transfers per month. Exceeding this limit can result in a fee, which may be around $5 to $15 per excess transaction.

Impact: Frequent withdrawals can quickly add up in fees, eating into your interest earnings.

Minimum Balance Fees

Some high-yield savings accounts require a minimum balance to avoid fees. If your balance falls below this threshold, a fee is charged.

Impact: If the minimum balance fee is $10 per month and you consistently fall below the threshold, you could lose $120 a year in fees, significantly reducing your interest earnings.

Account Closure Fees:

Some banks charge a fee if you close your account within a specific period (usually within 90 to 180 days of opening).

Impact: This fee, often around $25, can negate a portion of your interest if you decide to close the account early.

Paper Statement Fees:

Receiving paper statements instead of electronic ones can incur a small monthly fee.

Impact: Even a modest $2 monthly fee would result in $24 per year, which directly reduces your overall interest earnings.

Example of How Fees Affect Earnings

Let’s illustrate how fees can affect your earnings with an example:

Initial Deposit: $10,000

APY: 5.00%

Interest Earned in One Year: $500

Monthly Maintenance Fee: $10

Total Fees: $10 per month × 12 months = $120

Net Earnings: $500 (interest) - $120 (fees) = $380

Without fees, your account would grow to $10,500 after one year. However, with a $10 monthly fee, your account balance would be $10,380 instead, effectively reducing your APY from 5.00% to about 3.80%.

Mitigating the Impact of Fees

To minimize the effect of fees on your high-yield savings account earnings:

Choose Fee-Free Accounts: Many online banks and credit unions offer high-yield savings accounts with no monthly maintenance fees or minimum balance requirements.

Stay Above Minimum Balance Requirements: If your account has a minimum balance requirement, try to keep your balance above that threshold to avoid fees.

Limit Withdrawals: Stick to the allowed number of withdrawals to avoid excessive transaction fees.

Opt for Electronic Statements: Avoid paper statement fees by choosing electronic delivery.

Read the Fine Print: Always review the account terms for hidden fees or conditions that could impact your earnings.

While high-yield savings accounts offer a great way to grow your savings with higher interest rates, fees can quickly diminish your gains. By carefully selecting an account that minimizes or eliminates fees, you can preserve more of your hard-earned interest and maximize the benefits of a high-yield savings account. Always compare different accounts and consider both the APY and associated fees to make the most informed decision.

English (United States) ·

English (United States) ·