High-yield savings accounts have become an increasingly popular way for individuals to grow their savings while maintaining easy access to their funds. Unlike traditional savings accounts, which offer minimal interest rates, high-yield savings accounts typically offer rates that are significantly higher, sometimes exceeding 4% or more, depending on market conditions and the financial institution. This article will explore how much $5,000 can grow in a high-yield savings account over different time periods, such as 5, 10, 15, and more years. We will also discuss the factors that can affect your earnings, including the impact of compound interest.

What is a High-Yield Savings Account

High-yield savings accounts are designed to offer a safe and convenient place for your money to grow. They function similarly to regular savings accounts but with a much higher interest rate. The main features include:

Higher Interest Rates: These accounts offer rates that can be several times higher than those of traditional savings accounts.

FDIC Insurance: High-yield savings accounts are usually insured by the FDIC (or NCUA for credit unions) up to $250,000, protecting your deposits.

Easy Access: Unlike CDs or investment accounts, you can withdraw money without penalty, making it a flexible savings option.

Compounding Interest: The interest you earn is often compounded daily or monthly, which significantly enhances your total returns over time.

How Compound Interest Works

The magic behind high-yield savings accounts is compound interest. Compound interest means you earn interest on your initial deposit and on the interest that accumulates over time. This compounding effect accelerates your savings growth, especially over longer periods.

The formula to calculate compound interest is,

Where:

A = the amount of money accumulated after n years, including interest.

P = the principal amount (the initial deposit, which is $5,000 in this case).

r = the annual interest rate (expressed as a decimal).

n = the number of times that interest is compounded per year.

t = the time the money is invested for, in years.

Projecting Your Savings: 5, 10, 15 Years, and Beyond

To illustrate the potential growth of $5,000 in a high-yield savings account, let's assume an interest rate of 4% compounded monthly, which is a common rate for many high-yield savings accounts as of now. Below, we'll show how much $5,000 can grow over various time periods.

30-Year Savings Projections

| Years | Total Amount ($) | Interest Earned ($) |

| 5 | 6104.98 | 1104.98 |

| 10 | 7454.16 | 2454.16 |

| 15 | 9101.51 | 4101.51 |

| 20 | 11112.91 | 6112.91 |

| 25 | 13568.83 | 8568.83 |

| 30 | 16567.49 | 11567.49 |

The table showing the projected savings for 5, 10, 15, 20, 25, and 30 years has been created, displaying the total amount and interest earned over these time periods.

Projection Of Savings Growth Over Time

Here's the projection graph showing the growth of your savings over time. The solid line represents the total amount accumulated, while the dashed line shows the interest earned over the years. The graph visually illustrates how your savings and interest grow significantly, especially as the years progress due to the effect of compound interest.

How do different rates affect growth?

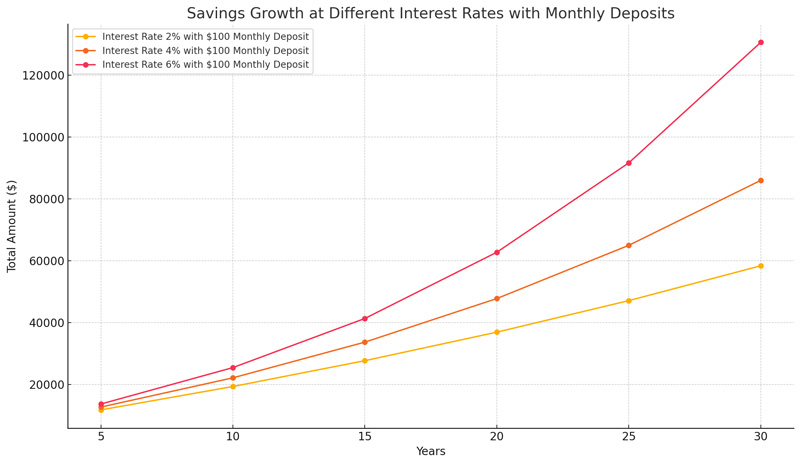

The interest rate of a high-yield savings account plays a critical role in how much your savings can grow over time. Higher interest rates lead to significantly larger amounts due to the compounding effect. To illustrate this, let's compare the growth of $5,000 at different interest rates over 5, 10, 15, 20, 25, and 30 years.

Comparison of Different Interest Rates

We'll explore the growth of $5,000 at the following interest rates:

2% (Low Rate): A conservative estimate for some traditional savings accounts or lower-end high-yield savings accounts.

4% (Moderate Rate): A common rate for many competitive high-yield savings accounts.

6% (High Rate): An optimistic rate that some accounts might achieve during favorable economic conditions.

Let's calculate and plot how different rates affect your savings growth over these time periods.

The graph above shows how different interest rates (2%, 4%, and 6%) impact the growth of your savings over time.

2% Rate (Low): The growth is steady but slow, reflecting more conservative savings growth.

4% Rate (Moderate): The growth rate accelerates, showing significant compounding effects over time.

6% Rate (High): The savings grow substantially faster, demonstrating how a higher rate dramatically boosts your total amount due to compounding.

As the rate increases, the compounding effect becomes more pronounced, especially over longer periods, leading to exponential growth in your savings. This highlights the importance of securing the best possible interest rate for your savings.

Key Fact

Long-Term Growth: The longer your money stays in the account, the more it benefits from compounding, leading to exponential growth over time.

Higher Rates Amplify Growth: The assumed rate of 4% is relatively modest. Some accounts may offer higher rates, further boosting returns.

Compound Frequency Matters: Monthly compounding is standard for savings accounts, but the more frequently interest is compounded, the greater the impact on growth.

Factors Affecting Your Savings Growth

Interest Rate Fluctuations: High-yield savings account rates can change, especially in response to Federal Reserve rate adjustments. Regularly checking your rate ensures you're getting the best possible return.

Additional Deposits: Making regular contributions will significantly increase your total savings. For example, adding just $100 monthly would boost your overall balance considerably over time.

Account Fees: While most high-yield savings accounts are fee-free, always check for hidden fees or balance requirements that could reduce your earnings.

Inflation: Inflation erodes the purchasing power of your money. Although a high-yield savings account offers good interest, it might still lag behind inflation, so consider diversifying your savings strategy.

Comparing High-Yield Savings Accounts with Other Savings Options

While high-yield savings accounts are great for liquidity and safety, they are just one piece of the savings puzzle. Here’s a quick comparison with other common savings and investment vehicles:

Certificates of Deposit (CDs): CDs often offer higher rates than savings accounts but lock your money in for a set period. They may be suitable if you don’t need immediate access to your funds.

Money Market Accounts: These accounts offer similar interest rates to high-yield savings accounts but may have check-writing capabilities and higher balance requirements.

Bonds or Treasury Bills: Bonds and Treasury bills can offer higher returns, but they come with different risk profiles and less flexibility compared to savings accounts.

Stocks and Mutual Funds: For long-term growth, stocks and mutual funds generally outperform savings accounts, but they also come with higher risk and no guaranteed return.

Maximizing Your High-Yield Savings Account

To make the most of your high-yield savings account:

Shop Around for Rates: Rates can vary significantly between institutions. Regularly compare accounts to ensure you're earning the highest possible interest.

Automate Savings: Set up automatic transfers to your savings account to consistently grow your balance without effort.

Avoid Withdrawals: Let your money grow by minimizing withdrawals and allowing compound interest to work its magic.

Monitor Rate Changes: Keep an eye on market changes and be ready to move your money if your rate drops significantly compared to other available options.

High-yield savings accounts offer a safe, flexible, and effective way to grow your savings over time, especially in the current low-risk environment. While they may not match the returns of riskier investments like stocks, the combination of safety, liquidity, and compound interest makes them an attractive choice for many savers.

Starting with $5,000 and letting it grow can lead to significant returns, especially if you commit to long-term savings. By understanding the power of compound interest, regularly comparing rates, and making strategic deposits, you can maximize your savings and work towards your financial goals with confidence.

Remember, the actual growth of your savings will depend on the interest rate, compounding frequency, and any additional contributions you make. High-yield savings accounts are a powerful tool, but always consider your overall financial plan and diversify your savings to balance growth and risk.'

What if I add monthly deposits?

Adding monthly deposits to your high-yield savings account can significantly boost your overall savings due to the combined effects of regular contributions and compound interest. When you make consistent monthly deposits, each new contribution immediately starts earning interest, which accelerates the growth of your total savings.

Let's compare how much $5,000 grows with monthly deposits of $100 at different interest rates over 5, 10, 15, 20, 25, and 30 years. We will focus on the same interest rates: 2%, 4%, and 6%.

| Years | Total at 2% Rate ($) | Total at 4% Rate ($) | Total at 6% Rate ($) |

| 5 | 11830.13 | 12734.88 | 13721.25 |

| 10 | 19377.96 | 22179.14 | 25484.92 |

| 15 | 27718.91 | 33710.56 | 41352.34 |

| 20 | 36936.32 | 47790.37 | 62755.11 |

| 25 | 47122.29 | 64981.78 | 91624.25 |

| 30 | 58378.58 | 85972.43 | 130564.38 |

The table shows the projected savings with monthly deposits of $100 at different interest rates (2%, 4%, and 6%) over various time periods.

5 Years: Savings range from about $11,830 at 2% to $13,721 at 6%.

10 Years: Savings range from about $19,378 at 2% to $25,485 at 6%.

15 Years: Savings range from about $27,719 at 2% to $41,352 at 6%.

20 Years: Savings range from about $36,936 at 2% to $62,755 at 6%.

25 Years: Savings range from about $47,122 at 2% to $91,624 at 6%.

These values illustrate how regular contributions, combined with compounding interest, can significantly boost your savings over time.

The graph above shows the impact of adding $100 monthly deposits to your savings at different interest rates (2%, 4%, and 6%):

2% Rate (Low): Even at a lower interest rate, consistent monthly deposits significantly boost the total savings over time.

4% Rate (Moderate): The combined effect of compound interest and regular contributions results in a much steeper growth curve.

6% Rate (High): The savings grow exponentially, demonstrating the powerful impact of high interest rates and consistent deposits.

Regular contributions greatly enhance the compounding effect, especially over longer periods, resulting in much higher total savings. This strategy is particularly effective for those looking to maximize their savings with minimal risk.

How much could I earn by 65 with $5,000 in a high-yield savings account?

To forecast how much you could earn by age 65 with an initial deposit of $5,000 in a high-yield savings account, we'll assume different interest rates and monthly deposits over various starting ages. This will help illustrate how starting early and consistently contributing can impact your savings significantly.

Assumptions for Forecast

Initial Deposit: $5,000

Monthly Deposit: $100

Interest Rates: 2%, 4%, and 6% (compounded monthly)

Starting Ages: Various starting ages from 25 to 55

Forecasting Growth by Age 65

We'll calculate the future value of your savings at different starting ages, assuming you contribute consistently until you turn 65. Let's create a table to display the projected amounts.

| Starting Age | Total Amount at 2% Rate ($) | Total Amount at 4% Rate ($) | Total Amount at 6% Rate ($) |

| 25 | 84563.86 | 142895.49 | 253936.34 |

| 30 | 70817.68 | 111601.94 | 183088.79 |

| 35 | 58378.58 | 85972.43 | 130564.38 |

| 40 | 47122.29 | 64981.78 | 91624.25 |

| 45 | 36936.32 | 47790.37 | 62755.11 |

| 50 | 27718.91 | 33710.56 | 41352.34 |

| 55 | 19377.96 | 22179.14 | 25484.92 |

The table shows how much you could earn by age 65 with an initial deposit of $5,000 and monthly deposits of $100, starting from various ages (25 to 55), at interest rates of 2%, 4%, and 6%. The results highlight the significant impact of starting earlier and securing higher interest rates on the total savings by retirement age.

English (United States) ·

English (United States) ·